Outsmart mule networks with AI-powered fraud detection

Satark is a real-time, AI-powered risk engine that detects mule accounts using profile, financial and non-financial transaction data, device intelligence, external signals and correlation with fraud databases. Built for banks and fintechs, Satark detects mule accounts using advanced AI models & algorithms and proactively identifies suspicious accounts and intent before fraud escalates.

Proven. Trusted. Recognised.

Trusted by India's Leading Banks

Need to know

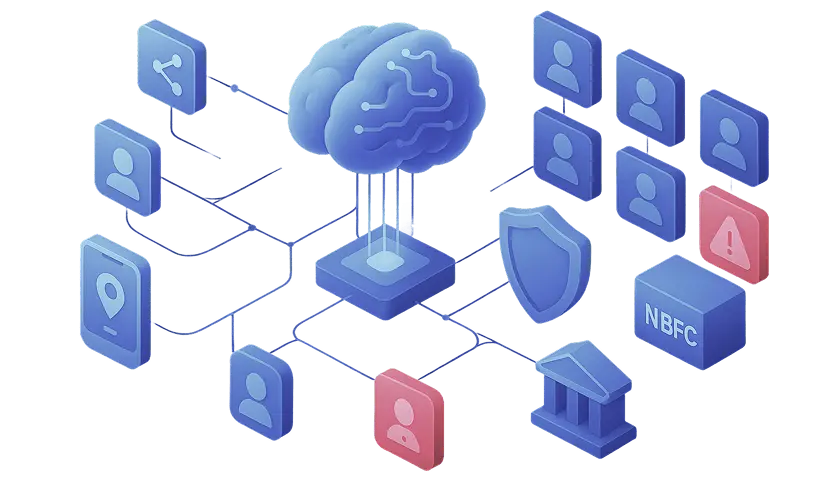

Comprehensive digital footprint

Satark brings together scattered user data from multiple data sources into a single view, enabling precise mule account detection.

Disrupt hidden mule networks

Identify hidden networks of mule accounts transacting with each other and track fund movements and money hops

Better detection, less disruption

Improve mule catch rates with advanced AI models, ongoing performance monitoring and feedback loops, without compromising user experience.

How it Works?

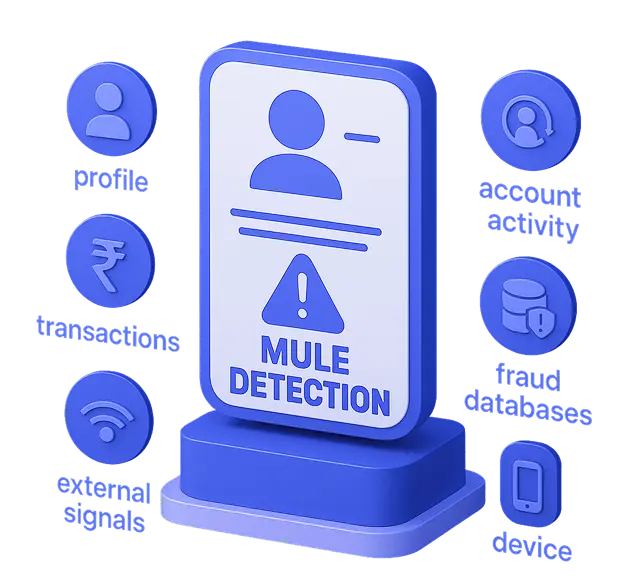

Mule Detection That Goes Beyond Transactions

Satark connects six critical signals–profile, transactions, device, account activity, external signals, and fraud databases. This creates a unified, real-time risk view of every user.

End-to-End Protection Across the Customer Lifecycle

Satark delivers end-to-end risk insights using AI/ML to detect mule accounts at the time of onboarding, during transactions and even ones hidden in your account base.

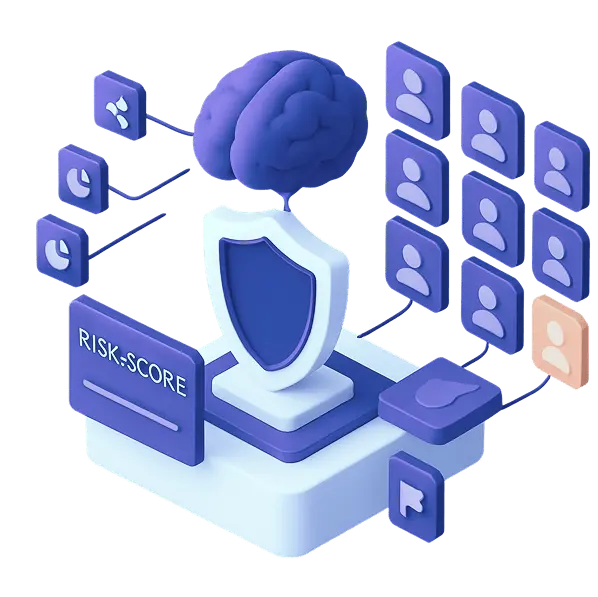

Satark can Detect 100+ Mule Patterns

Satark does not simply give a risk score but also reasons for flagging an account, enabling your teams to take cognizant action.

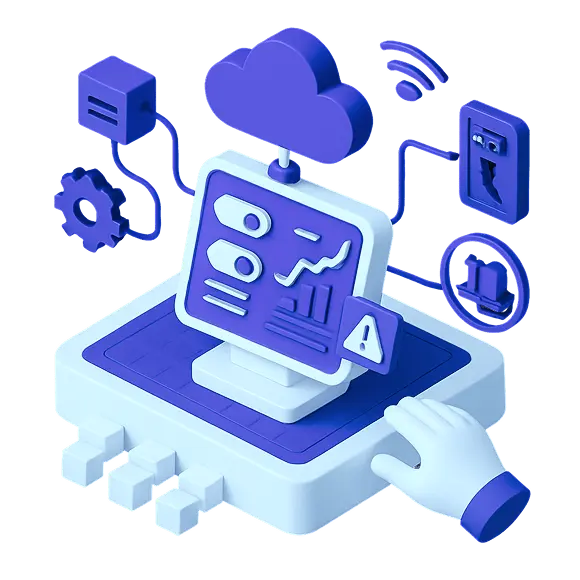

Easy Integration & Self-Serve Fraud Management Tools

Satark fits seamlessly into your systems, offering full control, flexible integration, and a self-serve dashboard built for scale without sacrificing speed or visibility.

FAQs

- Comprehensive Digital Footprint: Satark’s industry-first edge lies in building a holistic digital footprint for every user, integrating multiple data streams (profile, device, behavioural, transactional, and more). Unlike siloed tools, this approach evolves with new platforms and data sources, ensuring long-term relevance against evolving fraud tactics.

- Adaptive AI/ML Core: Powered by Generative AI, Deep Learning, Graph Analysis, and Vision Models, Satark goes beyond static rules to detect complex, hidden fraud patterns. Its models continuously learn from new data, adapting as criminals innovate, keeping banks a step ahead.

- Proven Expertise: Led by Google Pay co-founders with decades of experience in secure, large-scale financial systems, and backed by three years of deep research into mule accounts, our team brings unmatched expertise and foresight to fraud detection.

- Bank-Owned Deployment: Satark runs on the bank's own cloud or on-prem, ensuring complete data ownership and control.

- Regulatory-Ready: Fully aligned with RBI, NPCI, and Indian data protection norms.

- Strong Safeguards: End-to-end encryption and strict role-based access controls.

- Minimal Data Movement: Secure integrations via SFTP or APIs; no data leaves approved channels.

- Auditable: Every score and flag is explainable, transparent, and regulator-friendly.

- Profile & KYC Signals: Flags inconsistencies in demographics, disposable emails/phone numbers, or suspicious document details.

- Device Intelligence: Detects risky device setups (rooted phones, VPN usage, multiple accounts from the same device).

- Behavioural Red Flags: Identifies unusual onboarding flows, location/IP anomalies, and patterns linked to known mule networks.

- Fraud Databases: Cross-checks against NCCRP, NPCI complaints, and external watchlists to block repeat offenders.

- Live User Monitoring: Tracks transaction velocity, unusual credit/debit flows, risky merchant payments, and crypto/gaming wallet links in real time.

- Dormant to Active Accounts: Flags sleeper accounts that suddenly surge in activity, a common mule tactic.

- Backbook Scanning: Runs retrospective analysis of existing customer portfolios to uncover hidden mule rings in the system.

- Network Linkages: Identifies associations with known mule accounts across devices, VPAs, contact lists, and transaction networks.